Life insurance is a crucial financial tool that offers security for your loved ones in times of uncertainty. As we step into 2024, the insurance industry has introduced various life insurance plans designed to meet diverse needs, including high coverage, flexibility, and affordability. This guide highlights the best life insurance plans available in 2024, focusing on their unique features and how they can provide maximum coverage for policyholders.

What to Look for in a Life Insurance Plan in 2024

Before diving into specific plans, it’s essential to know what makes a life insurance policy worthwhile. Here are some key factors to consider:

- High Coverage Limits: Ensure the policy provides sufficient financial support for your dependents.

- Affordable Premiums: Choose a plan that balances coverage with cost.

- Flexibility: Policies that offer riders for critical illness, accidental death, or disability coverage can be invaluable.

- Reputation of the Insurer: Opt for companies with strong financial ratings and excellent customer service.

- Payout Reliability: A history of quick and hassle-free claim settlements is a significant advantage.

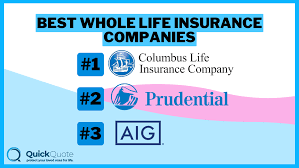

Top Life Insurance Plans with Maximum Coverage in 2024

1. ABC High Coverage Term Plan

- Type: Term Insurance

- Coverage: Up to $2 million

- Premium: Starts at $30/month

- Features:

- Pure protection plan with no maturity benefits.

- Riders available for critical illness and accidental death.

- Discounts for non-smokers and individuals with healthy lifestyles.

- Why Choose It?

This plan is ideal for individuals seeking high coverage at affordable rates, especially for young families and professionals.

2. XYZ Whole Life Policy

- Type: Whole Life Insurance

- Coverage: Up to $1.5 million

- Premium: Starts at $100/month

- Features:

- Provides lifelong protection with guaranteed payouts.

- Cash value accumulation that can be borrowed against.

- Flexible premium payment terms.

- Why Choose It?

This policy suits those looking for a combination of protection and investment, ensuring lifelong financial security for their family.

3. SecureGuard Universal Life Plan

- Type: Universal Life Insurance

- Coverage: Flexible, up to $2.5 million

- Premium: Variable, based on coverage and investment choices

- Features:

- Adjustable coverage and premium options.

- Investment component to grow wealth over time.

- Ideal for estate planning and long-term financial goals.

- Why Choose It?

SecureGuard is a perfect fit for individuals seeking customizable life insurance with an investment element.

4. FamilyFirst Joint Life Insurance

- Type: Joint Life Policy

- Coverage: Up to $3 million (shared between spouses)

- Premium: Starts at $80/month

- Features:

- Covers two lives under a single policy.

- Benefits are paid on the first or second death, depending on the plan.

- Option to add child protection riders.

- Why Choose It?

This plan is excellent for couples planning comprehensive financial security for their family.

5. PlatinumShield Critical Illness Rider Plan

- Type: Term Insurance with Riders

- Coverage: Up to $1 million for critical illness and $2 million for life coverage

- Premium: Starts at $50/month

- Features:

- Provides financial support in case of major illnesses.

- Lump-sum payouts for cancer, heart attacks, or strokes.

- Can be added to most term insurance policies.

- Why Choose It?

PlatinumShield is a must-have for individuals with a family history of severe illnesses, providing peace of mind and financial aid.

How to Choose the Best Plan for Your Needs

Selecting the right life insurance policy involves assessing your financial goals, family needs, and long-term obligations. Here are some steps to guide you:

- Evaluate Your Financial Situation: Calculate your existing debts, monthly expenses, and future goals like education or retirement.

- Determine Coverage Amount: A general rule of thumb is to opt for coverage 10-15 times your annual income.

- Compare Premiums: Use online calculators to estimate premiums for different policies.

- Understand Policy Terms: Read the fine print, focusing on exclusions and waiting periods.

- Consult an Advisor: Seek professional advice if you’re unsure about which plan to choose.

Benefits of High Coverage Life Insurance in 2024

- Peace of Mind: High coverage ensures that your family is financially secure in your absence.

- Estate Planning: Helps in passing on wealth to the next generation without legal complications.

- Tax Benefits: Premiums paid and payouts received are often tax-exempt, depending on your country’s regulations.

- Protection Against Inflation: A substantial coverage amount provides better protection against rising living costs.

Latest Trends in Life Insurance for 2024

The insurance industry is evolving rapidly to meet changing customer needs. Here are some key trends:

- Digital Platforms: Many insurers now offer policies that can be purchased and managed online.

- Customized Plans: Tailored policies allow customers to add specific riders and benefits.

- Health Incentives: Discounts on premiums for maintaining a healthy lifestyle are becoming popular.

- AI-Driven Claim Processing: Faster claim settlements are being implemented with artificial intelligence and automation.

Conclusion

Life insurance is more than just a financial product; it’s a promise to safeguard your family’s future. In 2024, the market offers diverse options catering to various needs, whether you want pure protection, lifelong coverage, or a mix of insurance and investment.

Choosing the right plan requires careful analysis of your financial situation, life goals, and family obligations. The plans highlighted above offer maximum coverage and are designed to provide peace of mind and financial security. Take the time to research, compare, and consult experts to find the plan that suits you best. After all, securing your family’s future is one of the most important investments you’ll ever make.